Business Intelligence

Written By: Sajagan Thirugnanam and Austin Levine

Last Updated on October 29, 2024

In the dynamic world of finance, timely and accurate reporting is crucial. Traditional financial reporting methods often involve manual processes and static reports, which can be time-consuming and prone to errors.

Enter visualization tools like Power BI—these tools revolutionize financial reporting by transforming complex data into interactive, insightful visualizations.

This blog will explore how Power BI can enhance financial reporting, the benefits it offers, and tips for effective implementation.

Introduction to Financial Reporting in Power BI

Power BI, a business analytics tool by Microsoft, allows users to create interactive reports and dashboards. For finance professionals, Power BI offers a robust platform to analyze financial data, track performance metrics, and make data-driven decisions.

What is financial reporting?

Financial reporting is the process of documenting and communicating financial activities and performance over specific time periods, be it on a quarterly or yearly basis.

Financial reports aim to provide accurate financial information about how a business is performing and help stakeholders know about the standing of the company in relation to its profit/loss margins.

Steps to Create Financial Reports in Power BI

Creating a financial report in Power BI follows most of the steps involved in creating any report in Power BI.

Just to recap, here are the steps required. For more in depth knowledge on how to create Power BI reports, you can read this blog here.

Step 1: Connect to Data Sources

Begin by connecting Power BI to your financial data sources. Import data from Excel, databases, or cloud services to create a unified data model.

Step 2: Prepare and Transform Data

Use Power Query to clean and transform your data. Remove duplicates, correct errors, and format data to ensure accuracy.

Step 3: Create Data Models

Define relationships between different data tables to create a comprehensive data model. This step is crucial for accurate data analysis and reporting.

Step 4: Design Visualizations

Design your financial reports using Power BI’s visualization tools. Create charts, graphs, and tables that effectively represent your financial data.

Step 5: Build Dashboards

Combine multiple visualizations into interactive dashboards. Dashboards provide a holistic view of financial performance and allow for in-depth data exploration.

Step 6: Share and Collaborate

Share your reports and dashboards with stakeholders. Use Power BI’s sharing and collaboration features to distribute insights and foster a collaborative environment.

Financial Report Examples

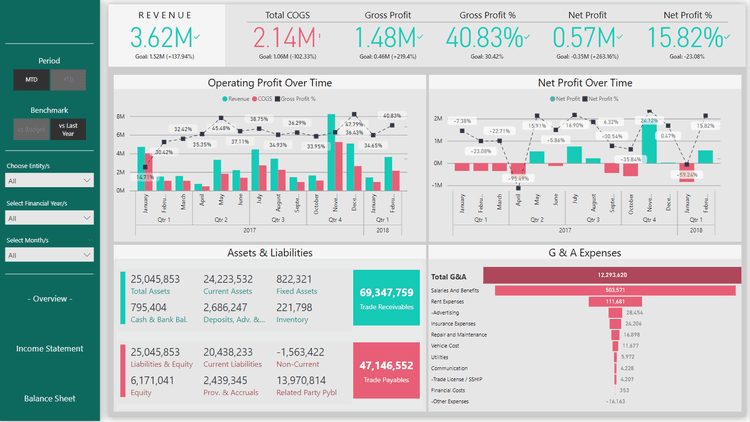

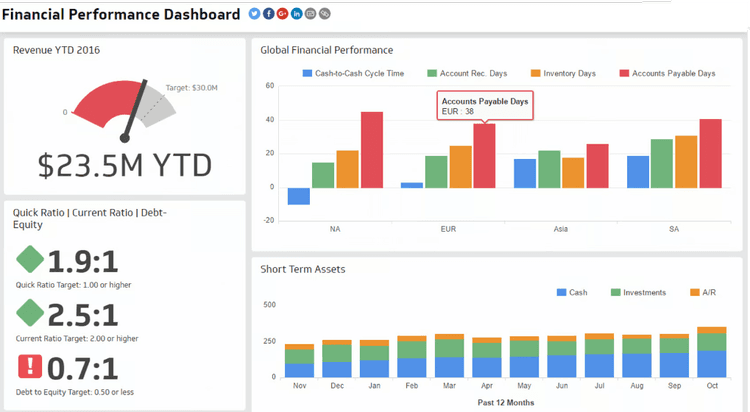

Financial Performance Dashboard

A financial performance dashboard can include key metrics such as revenue, expenses, profit margins, and cash flow. Visualizations like bar charts and line graphs can track trends over time.

These reports are the most basic form of financial reports as they are used by almost every company across the globe to track the company performance.

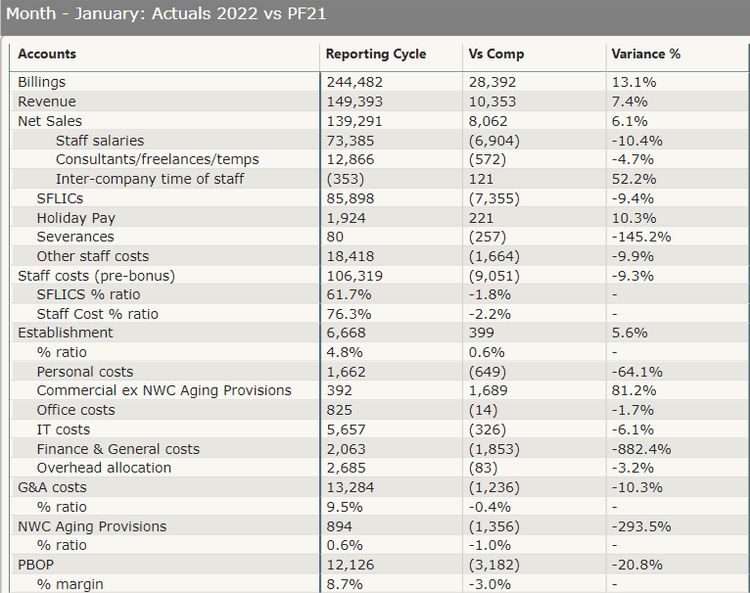

Income Statements

Income statements, aka profit and loss statements, are a form of financial reporting where we break down a company's revenues, expenses and net incomes for a specific period of time. In this manner, the company can know about its profitability and identify areas of optimization.

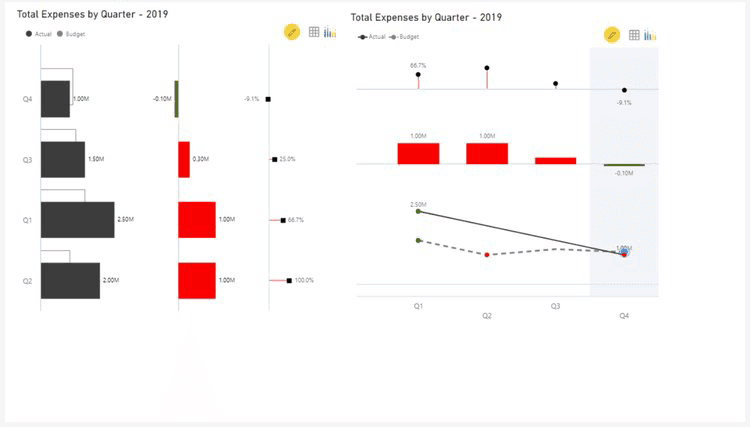

Expense Analysis Report

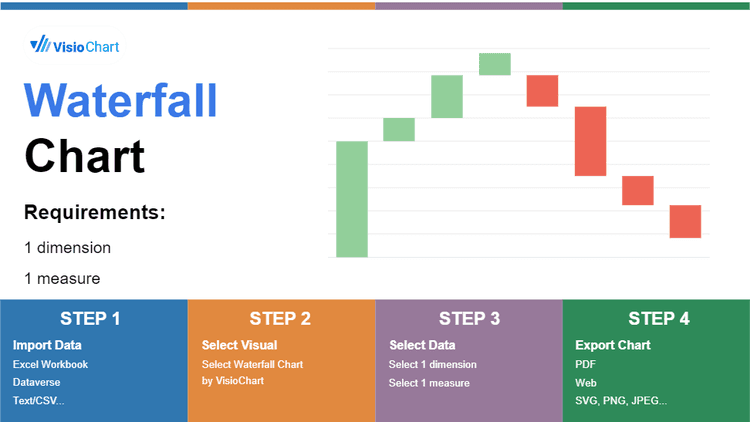

An expense analysis report categorizes expenses and identifies major cost drivers. Pie charts and waterfall charts can effectively represent expense breakdowns.

Best Charts For Financial Reports

Apart from the obvious charts which we use regularly in our daily reports, there are a few charts which are specially suited for financial reporting.

Let’s talk about a couple of these charts!

Variance Charts

Variance charts are a good way to show the variance in data points. For instance, these charts can be used to show the difference between Actual vs Forecast in your next financial report.

Waterfall Charts

These charts are interesting as they offer breakdown analysis. This means we can use it to visualize Income Statements and cash flows.

For example, we can visualize the distribution of the final balance in your next income statement.

There are many other custom charts on Power BI which can add value to your financial reports. Try exploring the custom visual panel in Power BI and utilize accordingly where applicable.

In Conclusion

Financial Reports are a key part of any small to large sized organization which means it is a vital part of our repertoire. I hope this blog serves as an opening into the world of financial reporting using Power BI and can act as a guide to such reporting in the future.

Do remember that financial reporting is just like any other reports: it completely depends on the use case and requirement as to how the final output of the report should look like. Study your requirement, ask questions to the stakeholder on how they want to use the report and ensure you keep the goal of the report in mind before creating the report.

Start exploring Power BI today and unlock the full potential of your financial data. To learn more about Power BI, remember to check out the other blogs on the Case When site where we dig deeper into the different capabilities of Power BI and other data related services.

FAQs

Can Power BI be used for financial reporting?

Yes Power BI is an excellent choice for any financial reporting thanks to its custom visuals and advanced data modeling capabilities.

Can I create financial statements in Power BI?

Yes, financial statements such as cash flow and profit and loss statements are easily built in Power BI using a plethora of custom visuals which are readily available in the visualization tool by Microsoft.

Related to Business Intelligence