Business Intelligence

Written By: Sajagan Thirugnanam and Austin Levine

Last Updated on November 1, 2024

Introduction: What Are Accounting Reports?

Accounting reports are structured documents that summarize an organization’s financial activities over a specific period. These reports are essential for analyzing financial performance, tracking business health, and guiding decision-making processes.

By providing a clear overview of financial data, accounting reports enable stakeholders—such as management, investors, and regulators—to understand the organization’s financial position and make informed decisions. This guide will cover the definition of accounting reports, their importance, key components, various types, and best practices for creating effective reports.

Importance of Accounting Reports

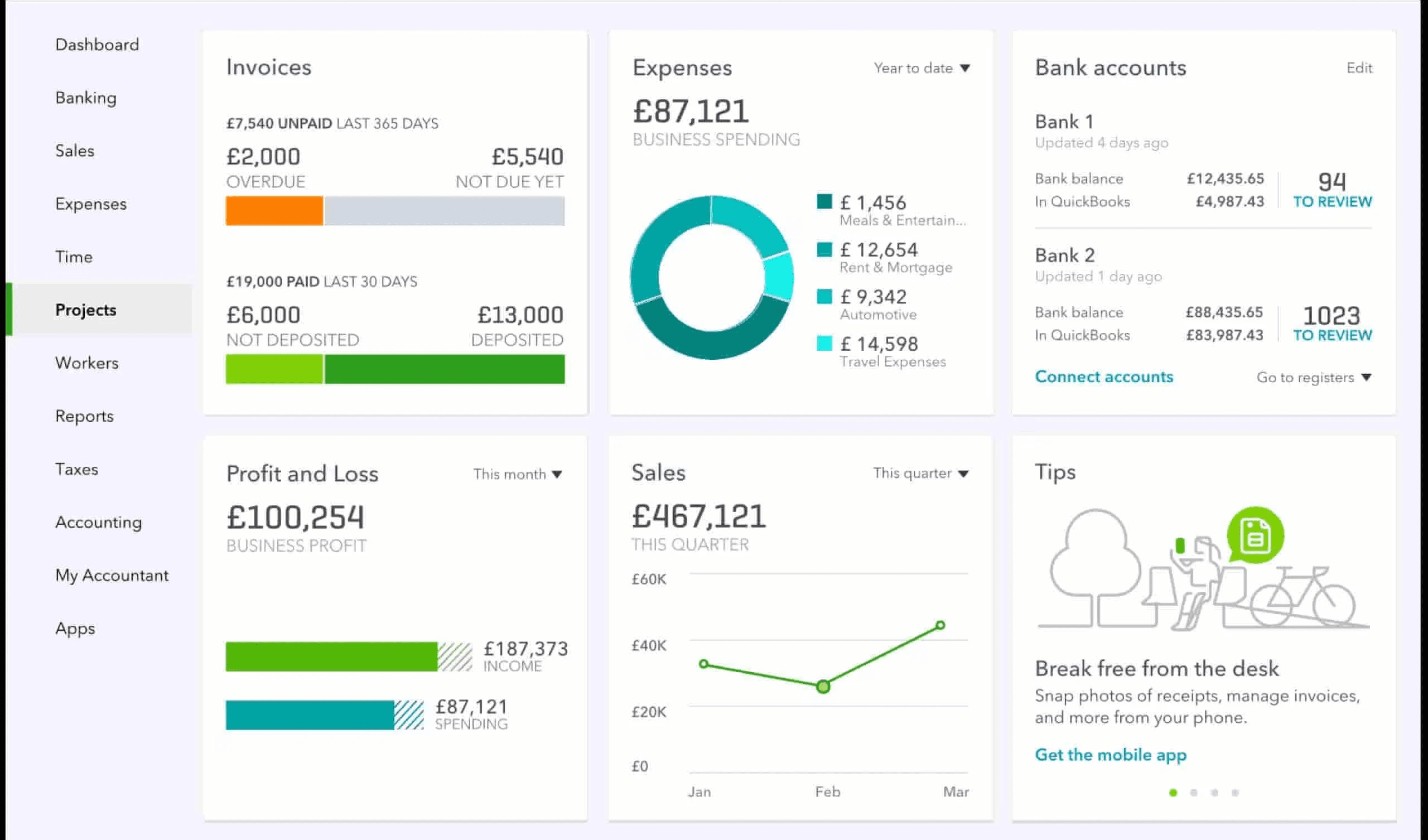

Source: QuickBooks - Intuit

Accounting reports play a pivotal role in business operations for several reasons:

Monitoring Financial Health and Performance: Regularly generated reports help organizations track their financial status over time, identifying trends and variances that require attention.

Aiding in Compliance with Legal and Tax Obligations: Accurate reporting ensures compliance with regulatory requirements and tax obligations, reducing the risk of penalties.

Enhancing Transparency and Trust Among Stakeholders: Well-prepared accounting reports foster trust among investors, creditors, and other stakeholders by providing a clear picture of financial health.

Enabling Strategic Planning and Budgeting: Historical data from accounting reports informs future budgeting decisions and strategic planning initiatives.

For example, a retail company may use monthly sales reports to adjust inventory levels based on seasonal trends, thereby optimizing stock management.

Key Components of Accounting Reports

Effective accounting reports consist of several key components:

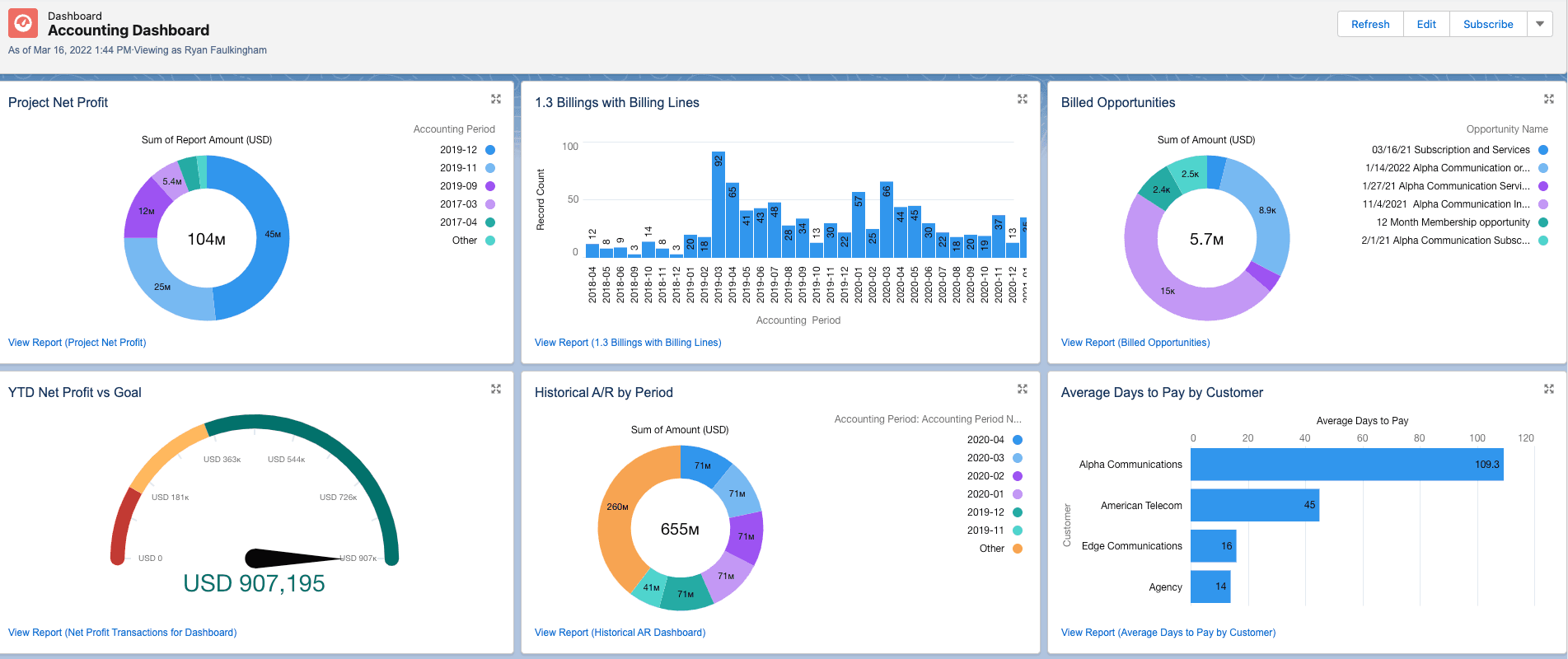

Source: Accounting Seed

Data Accuracy and Consistency

Accurate data is fundamental for reliable reporting. Organizations must implement rigorous data collection and verification processes to ensure that the information presented is correct.

Relevant Financial Metrics

Common metrics included in accounting reports are revenue, expenses, net income, cash flow, and profitability ratios. These metrics provide insights into the organization’s financial performance.

Compliance Standards

Following Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) ensures that accounting reports are standardized and comparable across different organizations.

Analysis and Interpretation

Moving from raw data to actionable insights is crucial. Effective reporting involves analyzing data to identify trends and making interpretations that inform decision-making.

Types of Accounting Reports

Understanding the different types of accounting reports is essential for effective financial management:

Income Statement (Profit and Loss Statement)

Source: Investopedia

Definition and Purpose: The income statement summarizes revenues and expenses over a specific period to determine net profit or loss.

Key Components: Revenue, cost of goods sold (COGS), gross profit, operating expenses, net income.

Example: A company may analyze its income statement quarterly to identify trends in profitability and adjust its pricing strategy accordingly.

Balance Sheet

Definition and Purpose: The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time.

Key Components: Assets (current and fixed), liabilities (current and long-term), shareholder’s equity.

Example: Investors might review a balance sheet to assess a company’s liquidity before making investment decisions.

Cash Flow Statement

Definition and Purpose: This report tracks cash inflows and outflows from operating, investing, and financing activities to assess financial health.

Key Components: Operating activities, investing activities, financing activities.

Example: A business can use its cash flow statement to evaluate whether it has sufficient cash to meet its short-term obligations.

Statement of Retained Earnings

Definition and Purpose: This report shows changes in retained earnings over a period due to net income or dividends paid.

Key Components: Retained earnings at the beginning of the period, net income for the period, dividends paid.

Example: Investors may analyze this statement to understand how much profit is being reinvested into the business versus distributed as dividends.

Budget vs. Actuals Report

Definition and Purpose: This report compares forecasted budgets with actual financial performance.

Key Components: Budgeted amounts, actual results, variances.

Example: A department manager uses this report to manage expenses effectively by identifying areas where spending exceeds budgeted amounts.

Trial Balance Report

Definition and Purpose: Lists all ledger account balances to check the accuracy of accounts before finalizing financial statements.

Key Components: Debit balances for each account versus credit balances.

Example: Accountants use trial balance reports during month-end close processes to ensure all accounts are balanced.

Accounts Receivable (A/R) Aging Report

Definition and Purpose: Lists outstanding customer balances categorized by due date.

Key Components: Aging categories (e.g., 30 days, 60 days).

Example: A/R aging reports help businesses manage collections by identifying overdue accounts requiring follow-up.

Accounts Payable (A/P) Aging Report

Definition and Purpose: Lists outstanding payables categorized by due date.

Key Components: Aging categories similar to A/R aging report.

Example: Companies use A/P aging reports to manage cash flow effectively by prioritizing payments based on due dates.

Inventory Report

Definition and Purpose: Summarizes current inventory levels along with stock turnover rates.

Key Components: Inventory quantity, cost per unit, turnover rate.

Example: Retailers analyze inventory reports to optimize stock levels based on sales trends.

Specialized Accounting Reports

In addition to standard reports, specialized accounting reports also play significant roles:

Variance Analysis Report

Purpose: Analyzes differences between budgeted figures and actual performance to identify areas needing attention.

Tax Reports

Purpose: Provides necessary information for tax compliance purposes including calculations for corporate tax returns.

Equity Reports

Purpose: Details changes in shareholder equity over time including capital contributions or distributions.

How to Create Accurate and Effective Accounting Reports

Creating effective accounting reports involves several steps:

Step 1: Define Objectives

Clearly outline the purpose of each report based on the audience's needs.

Step 2: Gather and Verify Data

Ensure data accuracy through reconciliation with source documents before reporting.

Step 3: Select Key Metrics and KPIs

Focus on metrics that align with your business objectives for meaningful insights.

Step 4: Use Appropriate Tools and Software

Utilize accounting software like QuickBooks or Xero that simplifies report generation while ensuring accuracy.

Step 5: Review and Validate Reports

Regularly review generated reports for accuracy before distribution; involve relevant stakeholders in this process.

Best Practices for Using Accounting Reports in Business

To maximize the effectiveness of your accounting reporting practices:

Consistency: Standardize report formats for ease of interpretation across departments.

Timeliness: Generate reports promptly so they remain relevant for decision-making processes.

Clarity and Simplicity: Use straightforward language with visuals where possible to enhance understanding.

Regular Review: Periodically revisit the reporting process to adapt it according to evolving business needs.

Data Security: Maintain stringent data privacy measures while complying with financial reporting standards.

Related to Business Intelligence