Unlock the Power of Your KYC Data

Transforming KYC Insights into Strategic Actions for Unmatched Compliance and Customer Understanding

Enhance Compliance: Gain real-time insights into customer profiles and risk levels.

Optimize KYC Processes: Streamline data collection and verification processes.

Predict Risk: Utilize predictive analytics to anticipate and mitigate potential risks.

What is KYC Data Analytics?

10 KPIs of KYC Data Analytics

How is Analytics Used in KYC Programs?

Enhanced Compliance

Enhanced compliance involves using data analytics to gain real-time insights into customer profiles and risk levels. Analytics helps track key metrics, evaluate compliance status, and identify opportunities for improvement.

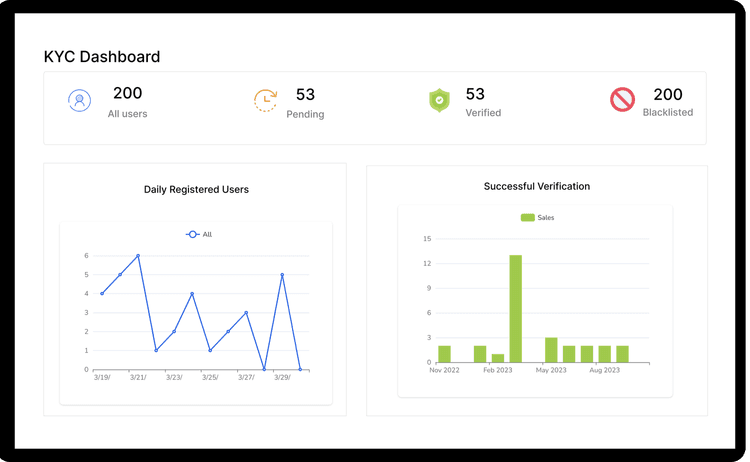

Example: Implementing a compliance dashboard to monitor KPIs such as customer risk score and KYC compliance rate, leading to more effective compliance strategies and faster identification of potential risks.

Benefit: Enhanced visibility into compliance status enables faster decision-making and improves the effectiveness of KYC efforts.

Optimized KYC Processes

Optimizing KYC processes means using data analytics to streamline data collection and verification processes. Analytics helps identify inefficiencies, automate verification steps, and enhance the overall KYC workflow.

Example: Using machine learning models to automate document verification and reduce manual review time, resulting in faster customer onboarding and improved accuracy.

Benefit: Better KYC processes increase efficiency, reduce costs, and enhance customer experience.

Risk Prediction

Risk prediction in KYC involves using analytics to anticipate and mitigate potential risks associated with customer profiles. Analytics can predict trends such as emerging risk patterns or changes in customer behavior, enabling proactive management.

Example: Applying predictive analytics to forecast potential high-risk customers based on transaction history, allowing companies to implement additional checks and safeguards.

Benefit: Proactive risk prediction enables companies to stay ahead of regulatory requirements, reduce fraud, and protect the organization from potential financial crimes.

By leveraging KYC data analytics, businesses can gain critical insights, optimize compliance operations, and predict customer risk profiles more effectively, leading to improved compliance performance and enhanced customer understanding.

CaseWhen's Innovative Approach

Unique Methodology for KYC Analytics

At CaseWhen, we redefine KYC analytics with an innovative methodology that surpasses traditional approaches. Our blend of advanced data analysis techniques and industry expertise provides actionable insights that drive strategic compliance decisions.

Advanced Analytics Techniques and Industry Expertise

What sets CaseWhen apart is the integration of cutting-edge analytics with deep compliance knowledge. This powerful combination offers a comprehensive understanding of your unique KYC challenges and opportunities, enabling us to develop tailored solutions that deliver measurable results.

Customized Solutions for Your Business

Recognizing that one-size-fits-all doesn’t work in KYC analytics, CaseWhen designs customized solutions that align with your specific compliance goals and requirements. Whether you need advanced risk scoring models, automated verification systems, or comprehensive compliance dashboards, we ensure our solutions are tailored to meet your business objectives.

Tailored Strategies: Solutions designed to meet your specific KYC needs.

Expert Insights: Leverage our deep industry knowledge for a competitive edge.

Proven Results: Enhance compliance performance with data-driven decisions.

Unlock the full potential of your KYC data with CaseWhen’s Data Analytics for KYC Program. Let us help you transform insights into actionable strategies that drive your business forward.