Unleash the Power of Your Financial Data

What is Financial and Accounting Data Analytics?

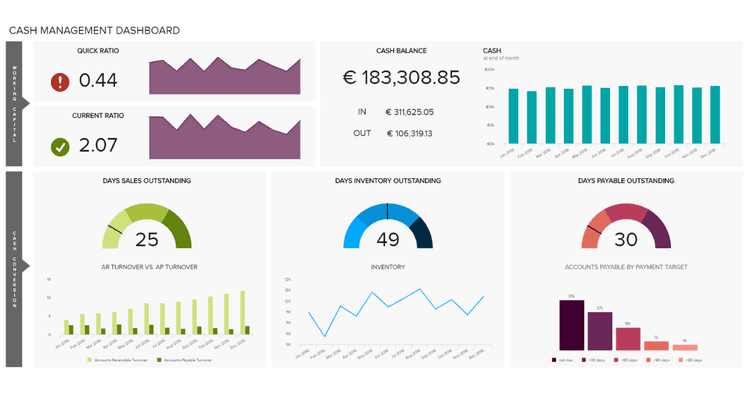

10 KPIs of Financial & Accounting Data Analytics

How is Data Analytics Used in Finance and Accounting?

Improved Financial Planning

Enhanced financial planning involves using data analytics to create more accurate and actionable financial forecasts. Analytics helps identify trends and predict future financial performance.

Example: Analyzing historical sales data to forecast future revenue trends. This enables more effective budgeting and strategic planning.

Benefit: More accurate financial forecasts can lead to better investment decisions and resource allocation, driving business growth.

Optimized Accounting Processes

Optimizing accounting processes means streamlining operations to enhance efficiency and reduce costs. Analytics helps identify bottlenecks and inefficiencies within accounting workflows.

Example: Using analytics to identify repetitive and manual accounting tasks that can be automated, reducing processing time and error rates.

Benefit: Streamlined processes improve overall efficiency, reduce operational costs, and enhance financial reporting accuracy.

Risk Management

Risk management involves using data analytics to identify and mitigate financial risks. Analytics can detect patterns and predict potential financial issues before they escalate.

Example: Applying predictive models to analyze cash flow trends and detect early signs of financial stress.

Benefit: Proactive risk management ensures financial stability and minimizes the impact of potential financial disruptions.

By leveraging data analytics in finance and accounting, businesses can gain deeper insights, optimize operations, and manage risks more effectively, driving sustainable financial performance.

CaseWhen's Innovative Approach

Unique Methodology for Financial Analytics

At CaseWhen, we redefine financial analytics with an innovative methodology that goes beyond traditional approaches. Our blend of advanced data analysis techniques and industry expertise provides actionable insights that drive strategic financial decisions.

Advanced Analytics Techniques and Industry Expertise

What sets CaseWhen apart is the integration of cutting-edge analytics with deep financial knowledge. This powerful combination offers a thorough understanding of your unique financial challenges and opportunities, enabling us to develop tailored solutions that deliver tangible results.

Customized Solutions for Your Business

Recognizing that one-size-fits-all doesn’t work in financial analytics, CaseWhen designs customized solutions that align with your specific financial goals and requirements. Whether you need advanced financial modeling, risk assessment strategies, or accounting process optimization, we ensure our solutions are tailored to meet your business objectives.

Tailored Strategies: Solutions designed to meet your specific financial needs.

Expert Insights: Leverage our deep industry knowledge for a competitive edge.

Proven Results: Enhance financial performance with data-driven decisions.

Unlock the full potential of your financial data with CaseWhen’s Financial and Accounting Data Analytics Service. Let us help you transform insights into actionable strategies that drive your business forward.